currency arbitrage algorithm|Currency Arbitrage Using Floyd Warshall : Manila Abr 21, 2019 — In the previous post (which should definitely be read first!) we explored how graphs can be used to represent a currency market, and how we might use shortest . Ігрові автомати Huangdi - The Yellow Emperor онлайн на реальні гроші в онлайн казино Slots City® Краще ліцензійне казино України. Грай безкоштовно або на гроші і отримуй свої бонуси.

PH0 · c++

PH1 · What is Currency Arbitrage and How Does it Work?

PH2 · Triangular Arbitrage: Definition and Example

PH3 · Lecture 17

PH4 · Graph algorithms and currency arbitrage, part 2

PH5 · Graph algorithms and currency arbitrage, part 1

PH6 · Currency Arbitrage: Definition, Types, Risk and Examples

PH7 · Currency Arbitrage: Definition, Types, Risk and

PH8 · Currency Arbitrage: An Overview Of Definition, Types And Risks

PH9 · Currency Arbitrage Using Floyd Warshall

PH10 · Arbitrage using Bellman

PH11 · An algorithm for arbitrage in currency exchange

But also, from there you'll access another area that conects to City of Tears. Or you can always explore any path you see as unexplored on your map, anywhere is as good as any other place, there is not a right or wrong path. You don't need to go back to City of Tears right now, there are lots of other things to do and no intended order for them

currency arbitrage algorithm*******Design an efficient algorithm to determine whether there exists an arbitrage - a way to start with a single unit of some currency and convert it back to more than one unit of that currency through a sequence of exchanges. Tingnan ang higit pa

Mar 2, 2019 — Part 1 (this post) will lay the theoretical groundwork, introducing graph algorithms and giving an overview of their application to currency arbitrage. In Part 2 we will present an actual implementation of .Use modified Dijkstra's algorithm to find single source longest product path. This gives longest product path from source currency to each other currency. Now, iterate over .Shortest path algorithms are invalid when negative cost cycles exist because there cannot be shortest paths! Bellman-Ford can actually detect these negative cost cycles:Abr 21, 2019 — In the previous post (which should definitely be read first!) we explored how graphs can be used to represent a currency market, and how we might use shortest .

Hul 11, 2023 — Currency arbitrage, also known as forex arbitrage, involves taking advantage of variations in exchange rates to generate profits with minimal risk. This .If we are given some coins $c_1, c_2, \dots, c_n$ and an array $R$ that keeps the selling price, where $R[i,j]$ is the selling price of one unit of currency $c_i$ to currency $c_j$. a) .Mar 19, 2024 — Triangular arbitrage is a form of low-risk profit-making by currency traders who exploit exchange rate discrepancies through algorithmic trades.

Hun 22, 2023 — Currency arbitrage is a forex strategy in which a currency trader takes advantage of different spreads offered by brokers for a particular currency pair by making trades.

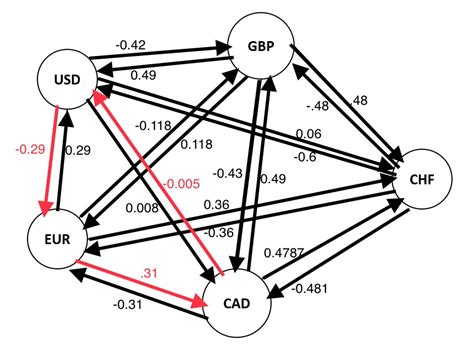

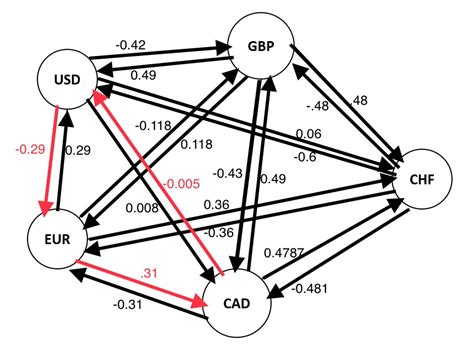

May 29, 2018 — Solution 2: Floyd-Warshall algorithm. We can do better than O(n!) by modifying FW. The original algorithm finds all (I know, right!) shortest paths in a directed .Currency arbitrage involves simultaneously buying and selling currencies in different markets to profit from temporary price differences. The model is formulated as a linear program to find the currency conversion amounts that maximize profits through arbitrage opportunities across multiple currencies.The Arbitrage class provides a client that finds an arbitrage opportunity in a currency exchange table by constructing a complete-digraph representation of the exchange table and then finding a negative cycle in the digraph. This implementation uses the Bellman-Ford algorithm to find a negative cycle in the complete digraph.assignments, “give an algorithm” entails providing a description, proof, and runtime analysis. Problem 7-1. Arbitrage Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. Suppose, U.S. dollar bought Euro, Euro bought49 th Friday Fun Session – 2 nd Feb 2018. Negative Cycle can be identified by looking at the diagonals of the dist[][] matrix generated by Floyd-Warshall algorithm. After all, diagonal dist[2][2] value is smaller than 0 means, a path starting from 2 and ending at 2 results in a negative cycle – an arbitrage exists. However, we are asked to .A new risk-free arbitrage algorithm is proposed to identify the best arbitrage opportunity by finding the negative weight closure path in the directed graph model. Although some conventional arbitrage methods are theoretically appropriate, it has only recently been considered that it is impossible to capture these arbitrage opportunities with a .currency arbitrage algorithmAgo 2, 2020 — I'm searching for a way to apply an arbitrage algorithm across multiple exchanges, multiple currencies. and multiple trading amounts. I've seen examples of using BellmanFord and FloydWarshall, but the one's I've tried all seem to be assuming the graph data set is made up of prices for multiple currencies on one single exchange.Hul 3, 2012 — For the question "are matrices useful to identify arbitrage opportunities available in multi-currency conversions?", the answer is yes. You would use a matrix to store each conversion rate from currency i to currency j in cell (i,j).. For the question "would an algorithm that finds such opportunities be similar to a shortest path finding .

For context, currency arbitrage is the process of buying and selling currency pairs to make a profit. Currency arbitrage is possible because of market inefficiencies, so this program enables traders to both profit and reduces market inefficiencies.The Bellman Ford algorithm got famous for quickly solving the 'shortest path problem' on directed graphs. It's application to currency trading is due to the fact that if there are still "relaxable edges" on a currency rates' matrix, then there is a negative cycle, which represents an arbitrage opportunity.Currency Arbitrage Using Floyd Warshall Dis 5, 2019 — Each of the following 𝑅 lines contains one exchange rate in the following format: first currency code, space, second currency code, space, integer number 𝐴𝑖, colon (’:’), and integer number 𝐵𝑖. The meaning is as follows: If you pay 𝐴𝑖 units of the first currency, you will get 𝐵𝑖 units of the second currency.

Arbitrage using Bellman-Ford Shortest Paths Algorithm. Suppose you are given a set of exchange rates among certain currencies and you want to determine if an arbitrage is possible, i.e, if there is a way by which you can start with one unit of some currency C and perform a series of barters which results in having more than one unit of C.

Arbitrage From? 6 items selected. Arbitrage To. 6 items selected. Quotes 5 items selected. Select All Deselect All. Top 100 Refresh. Profit Quote Base Asks Bids Wallet; Loading. No records available. 2024 Xypher Twitter/X .Set 5, 2019 — Arbitrage. Arbitrage is the use of discrepancies in currency exchange rates to transform one unit of a currency into more than one unit of the same currency. For example, suppose that 1 US Dollar buys 0.5 British pound, 1 British pound buys 10.0 French francs, and 1 French franc buys 0.21 US dollar.currency arbitrage algorithm Currency Arbitrage Using Floyd Warshall Hun 6, 2020 — site Link:https://sites.google.com/view/kamaltulsiyani/homeReport PDF Link:https://drive.google.com/file/d/1Yw9ruXrE4Bmqg41 .Level up your coding skills and quickly land a job. This is the best place to expand your knowledge and get prepared for your next interview.

Algorithm for identifying currency arbitrage opportunities Topics. forex arbitrage forex-trading bellman-ford-algorithm arbitrage-opportunity arbitrage-trading Resources. Readme License. MIT license Activity. Stars. 8 stars Watchers. 3 watching Forks. 1 fork Report repository ReleasesHul 11, 2023 — Currency arbitrage often relies on advanced trading platforms, algorithms, and data feeds. There is a risk of technological failures, such as system glitches, connectivity issues, or data inaccuracies, which can disrupt trading activities and result in financial losses.ideas in arbitrage algorithms. First, the difference between detecting an arbitrage opportunity and detecting the optimal arbitrage solution, thus creating an alternative that not only finds the best solution, but those closest to it. To this end, he introduced quantum resolution by transforming

How to Make a Deposit. Top Questions. How can I request a bet? (#NameYourPlay) The Bodog Guarantee - Always committed to our players. How do I deposit with a cryptocurrency? (Bitcoin, Litecoin, etc.) How do I withdraw with a cryptocurrency? (Bitcoin, Litecoin, etc.) What deposit methods are available? What is a Parlay?

currency arbitrage algorithm|Currency Arbitrage Using Floyd Warshall